It seems a very sensible idea: paying only for the news you read, article by article. At a few cents apiece, there is no cost barrier, and publishers are compensated by readers directly, in direct proportion to the popularity of content.

This is the micropayment model. The idea has been around as long as the Web itself, and for all that time it has failed. The glorious dawn has faded time after time. Well, this week I’ve spoken to an Australian startup who say the sun is coming up again.

If you are reading this article and you’re not a subscriber, please consider signing up to the Crawford Media newsletter.

The tortured history of micro-news

A lot of people have put a lot of thought into finding a way to pay for news online over the past 20 years. Pay-per-article has not escaped their attention. In Australia experiments such as Tapview and Nanotransactions came and went. Internationally, the Dutch company Blendle held huge promise for several years beginning in 2014. Blendle’s model was smart and well-executed, bringing together the best Dutch publishers in a single digital platform where readers could pay per article. There was even an option for readers to get refunds on unsatisfactory articles. Hundreds of thousands of people were signed up to the system.

But over time Blendle turned towards subscriptions for packages of content, which in turn undermined its relationship with publishers who offered their own subscriptions. An expansion into the US market did not succeed. Last year the company was sold to French subscription aggregator Cafeyn and this year founder Alexander Klöpping stepped down. In explaining why the company turned away from micropayments and towards subscriptions, Klöpping said not only did subscribers (“premium members”) provide a more stable source of income, they were three times as engaged as pay-per-article readers.

New kids on the block

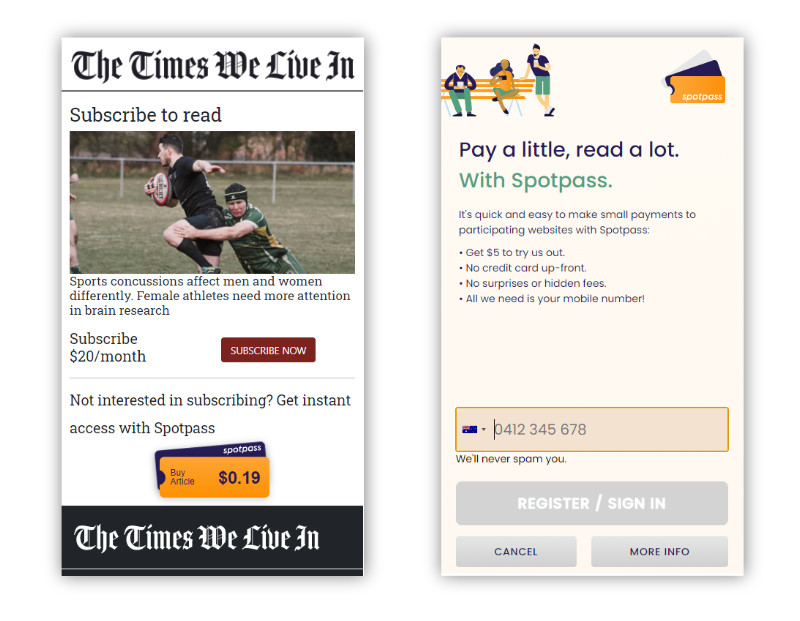

Spotpass is the micropayment newcomer to the Australian media landscape, and judging from their business model and pitch, this won’t be the last you hear of them. There are enough differences in their approach and makeup to warrant serious attention.

I spoke to CEO Doug Howe and Chief Revenue Officer Adam Kershaw. Howe is a micropayments guy, responsible for Sydney’s Opal transit payment system, and Kershaw is the former New York Times general manager for Australia. The first thing Kershaw says makes me prick up my ears: he joined Spotpass because it was founded by people outside news.

“I wasn’t really looking to get back into media … [but] I thought to myself, my god, these guys are actually going to pull this off because they’re not from media. They’re payments guys.”

Before I go into the arguments, though, I’m going to tell you exactly how the system works. The details matter.

Spotpass is a payment system, integrated on a publisher’s website, that grants access to individual articles. The article price is set by publishers but restricted to 1-99 cents. The Spotpass button appears on the paywall blocking page, along with the publisher’s subscription message. If you click and pay, you’re through to the article without having to commit to a subscription. In addition to this “Spot Access”, there are three other Spotpass products: donations, timed section passes, and weekly subscriptions.

Spotpass is not what some people call a “kiosk”, an aggregation in one place of many publishers’ content. This sets it apart from Blendle and Australian subscription-based aggregator Inkl.

I ask Howe and Kershaw the key question: do they see their primary client as the publisher or the audience?

“The audience comes first,” says Howe. Right answer from my point of view.

I attempt to shoot it down

Any good idea has to be able to withstand an assault, and a micropayment startup had better be ready for a ferocious defence.

This will cannibalise subscriptions. Why would any publisher agree to it?

According to the Reuter’s Institute Digital News Report 2021, only 13% of Australians pay for news. Howe says many publishers are becoming experienced in subscriptions, and after years of growth are seeing numbers plateau. Howe:

“There are some that are more sophisticated that recognize subscription fatigue. There are some new entrants going, ‘Hey, I’m seeing such great uptake of subscription’, but they’re coming from a base of nothing. It’s the ones that have been doing this for a number of years that really see that subscription fatigue. They’re getting a lot of churn.”

Kershaw says based on this experience, many publishers will be able to identify users who will probably never subscribe. Spotpass can be targeted at these people.

“Publishers have the ability to present Spotpass offers based on propensity to subscribe … so for example, [they could] show the Spotpass button to people who only come in from Facebook and … get something from them beyond that fraction of a cent [from advertising].”

How will Spotpass overcome audience hesitancy to sign up to a new service?

Howe takes me through the experience of a first-time user. Borrowing the idea of gift credit (Blendle also did this), the new user only has to enter a mobile phone number, which is then verified. The cost of the article comes off the $5 credit. When (in several article’s time), credit is reduced to zero, the user enters a credit card number. If it works like this in real life, I’m impressed.

Why don’t publishers just do it themselves?

Howe says some of the bigger publishers they have spoken to – the ones where subscription growth is slowing – see the advantage in having a universal system. Their content will receive exposure to people who are also consuming their competitors’ content. It’s a way out of the silo.

What is Spotpass’ cut?

“I’d rather not go to print with that just yet … we are cheaper than doing it through any payment gateway because we aggregate up transactions. We work on a percentage model.”

The odds

Howe and Kershaw make a convincing argument, and like Kershaw, I think the payments expertise is the critical thing here. Past attempts have foundered on costs per transaction and the “friction” in signing up new users. I am pretty sure the system will work for the audience – box ticked – but how the publishers react is the next important step for Spotpass.

Howe says they are in discussions with several big names, and will go live with the donation button on the Times News Group’s (Victorian regional news) sites later this month.

“Our plan is to go global. You only have to follow stories like Afterpay to know how easily possible that is. It’s about getting that consumer proposition right first, and then making sure that the publishers see an uplift in incremental revenue.”

The timing is important here, and could be on Spotpass’s side. I am increasingly hitting paywalls – news links from friends, commentators, aggregators and search – and being turned away like an orphan. I don’t like it, but I don’t intend to subscribe to everything. It is a shame that the great hope of news media should also be a fundamentally negative experience for so many people. For this reason, I hope Spotpass or a similar payment system gains traction.

Provenance of this piece

I have no financial interest in Spotpass. Director Bruce Davidson (ex CEO AAP) drew the company to my attention. Key people not mentioned in this piece are: Mark Lillywhite (CTO) and Garry Duursma (Chairman).